Before you apply for a mortgage, raising your credit score is just one of the greatest issues perform. Meaning paying down as frequently debt as you can. But many people have many personal debt owing to no-fault of their own. Regarding the 41% out of U.S. people enjoys medical loans. Scientific expenses are also the newest #step one cause for bankruptcy throughout the You.S.

Medical financial obligation can result in you to definitely reduce shelling out for rules such as restaurants. This may also stand-in the right path should you want to buy a property. Personal debt is a significant part of your credit score – in the event it takes ages to pay off a https://paydayloanalabama.com/rock-mills/ loans, your credit score are affected. But life that have scientific obligations is going to score much easier.

At the time of , of many kinds of medical loans shall be from your credit score. Specific kinds of medical loans you will not advertised at all in the years ahead. This transform is designed to make it easier to manage yours well-getting. Unanticipated scientific expenditures can become pricey, and additionally they should not block the way of your feature to acquire a property. Here is what you have to know.

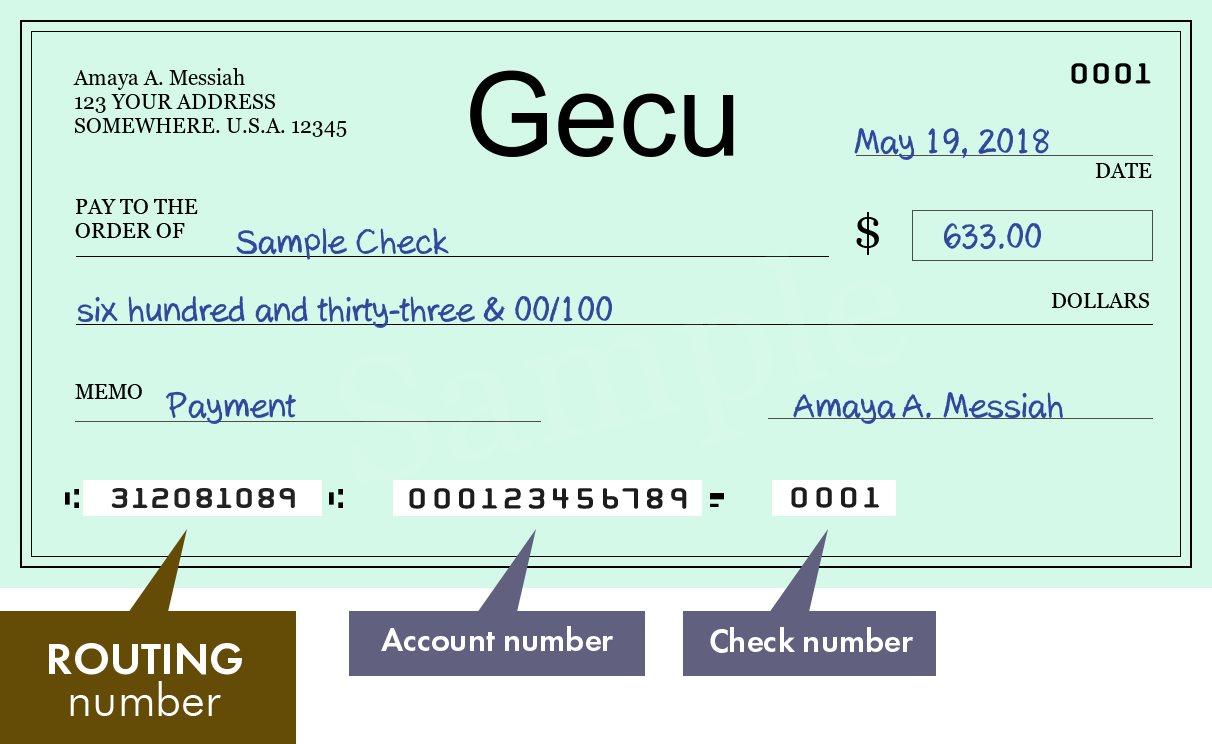

Any time you explore credit cards, remove that loan or shell out a loans, its submitted in your credit report. The positive and negative incidents regarding report are acclimatized to carry out a credit history. A credit history try a quote from how almost certainly its you’ll spend your financial situation fully and on big date.

Credit ratings start around 300 (a reduced) so you’re able to 850 (the highest). Only a small percentage of men and women possess a rating off 850. Everything from 670 so you can 739 represents a beneficial. A good credit score is very important as borrowers that have highest score could possibly get best mortgage loans.

Exactly why are home financing better otherwise worse? A massive grounds ‘s the interest. Mortgage loan try a % of the home loan set in the loan balance throughout a-year. For every single mortgage repayment comprises of a mixture of the latest attention additionally the principal (the original equilibrium of your financing).

The eye on your own mortgage provides cash toward bank, and you will spending it does not enable you to get nearer to settling the domestic. The greater their interest, the more you spend eventually, together with expanded it entails to repay their financial. All penny of dominating which you pay back was domestic security (value) you handle, and you may will get your closer to repaying the mortgage.

Credit ratings, Scientific Obligations, and buying a house

- Medical personal debt that was in earlier times inside series, you have now repaid, will stop showing up in your credit report

- You’ll actually have 12 months to deal with any medical financial obligation from inside the collections before it appears in your credit report

- Inside the 2023, medical loans out-of less than $five-hundred inside the stuff would-be removed from the credit reporting agencies no prolonged stated

Such transform try planned for a large difference to have potential housebuyers across the board-plus one of the most affected teams would-be Millennials. Within the a recently available questionnaire, respondents round the all the years told you medical obligations provides damage its credit. Millennials fared brand new worst, that have 52% revealing a bad impact.

Credit ratings, Medical Financial obligation, and buying a property

- For people who discovered a medical statement, it is essential to know acknowledgment of one’s bill.

- If you see problems into the expenses, you can freeze this new clock into stuff by letting the new seller discover the possibility mistakes. It is critical to observe that an estimated 80% regarding medical costs features errors .

Even in the event medical personal debt has already established a negative effect on your credit rating, discover options for preserving your mortgage rates of interest reduced. To understand more about home mortgages getting low- and modest-income group, consider our TruePath Home loan equipment regarding TCHFH Financing, Inc. The rate is gloomier compared to the industry mediocre, and you can house costs was capped in the 31% of one’s money.