If you find yourself there are not any well-known otherwise large restrictions precisely how people may use a HELOC, it’s important to just remember that , in charge fool around with is key having staying on track which have money and you may staying in a good condition that have the bank

- Combining highest-attract debt: If you have an excellent loans to your credit cards or any other sizes out-of financing that are included with a high rate of interest, you might reduce your full financial accountability in case the HELOC has the benefit of a diminished interest. not, you nevertheless still need to understand what caused the accumulation of that personal debt or take methods to handle one to options issue, if necessary.

- Investing yet another or present business: In the event that search, https://paydayloancolorado.net/central-city/ thought and you will due diligence shows that your layout to own an alternative business is practical, a good HELOC will likely be a supply of investment for the new venture. Furthermore, you can utilize an excellent HELOC to fund advancements so you can a preexisting organization. Keep in mind that there’s constantly an economic risk whether it concerns creating otherwise broadening a friends.

HELOCs may also be used in order to satisfy tall expenses that feel conserved for more than go out, however, should be paid for more readily. Examples include:

When you’re there aren’t any known otherwise broad limitations about how precisely home owners may use good HELOC, it is vital to understand that responsible play with is vital to own becoming focused with money and you can staying in an excellent standing with their financial

- Supporting the knowledge from an infant: You can look at taking right out a great HELOC to fund undergraduate otherwise graduate tuition and you will costs while you are building a plan to shell out straight back the amount due since the repayment months starts.

- Dealing with extreme scientific expenditures: Scientific debt normally appear rapidly and you can involve high will set you back. A HELOC also provide the funds wanted to avoid major financial difficulty in the short term and provide you with time for you package for upcoming installment.

Throughout the really standard conditions, a good HELOC shouldn’t be useful costs that cannot getting addressed with money or other possessions achieved till the installment period starts, or during the it.

The newest specifics of in control HELOC play with vary in one person to another predicated on money, financial investments, necessary costs and you can budgeting. Generally, you should avoid significant sales which have a HELOC without a plan to handle your debt because fees term comes. There’s nothing completely wrong which have having fun with a good HELOC to pay for a holiday, home improvements that almost certainly would not incorporate extreme worth and other expense as long as you enjoys an excellent strategy for expenses one to cash return when the time comes.

Just as is the situation having a charge card, you ought to have a monetary policy for repaying brand new loans obtain by using your credit line

HELOC finance might be especially useful for people who see a number of secret official certification one put the conditions and terms on your side:

Whenever you are there aren’t any celebrated or greater limitations regarding how home owners may use a great HELOC, it is very important understand that responsible explore is key to have being on course having repayments and you may remaining in a good status with their lender

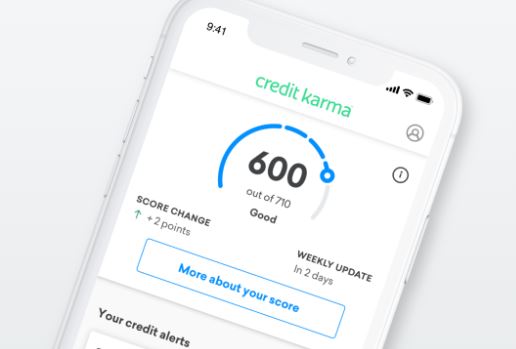

- A strong credit rating: Your credit rating often impact whether you qualify for the new range away from borrowing from the bank plus determine the interest rate the bank proposes to you.

- A high rate from guarantee of your house: This new shorter that is owed on the family, the greater amount of borrowing from the bank the financial could possibly offer within the an effective HELOC.

- The lowest debt-to-money ratio: Debt-to-earnings proportion stands for just how much money available immediately after addressing continual obligations. A lower life expectancy financial obligation-to-earnings ratio try prominent for some lenders.

HELOCs are not such as difficult, but their unique character keeps lead to some traditional misconceptions regarding the them. Responding the question how does a good HELOC works? setting expertise its purpose, common spends and you can popular but incorrect assumptions about this distinctive line of borrowing.

This can be a really popular misconception to own HELOCs. Property security credit line and you will a house collateral financing is actually one another particular home-covered loans you can deal with to view the present collateral of your house. not, they disagree high in the way finance is actually marketed, accessed and you may paid off: