Declaring personal bankruptcy should be a difficult and challenging months from inside the your financial trip. However, just like the bankruptcy processes are hard, and can lead to serious economic hurdles, additionally, it is a relatively common option to favor. Instance, annual case of bankruptcy filings totaled 452,990 from inside the 2023, centered on research regarding Administrative Office of your U.S. Process of law – a rise off almost 17% compared to the 2022, when 387,721 bankruptcy proceeding circumstances were filed.

Given the latest pressures posed by the the present financial environment, the rise inside the case of bankruptcy filings season-over-year is practical. For one, persistent rising prices facts keeps led to high costs with the individual merchandise, resulting in finances is longer slim. And you can, the present day highest-speed environment has actually triggered significant credit will cost you across the board, putting a great deal more stress on of several man’s profit.

However, if you submitted to own case of bankruptcy has just – otherwise are preparing to – it’s important to keep in mind that bankruptcy need not become a-dead avoid. Actually, it can be a kick off point to possess reconstructing your financial health, and if you are a homeowner, obtaining property guarantee loan tends to be an important help you to definitely procedure. Having said that, it won’t be a straightforward path to protecting a property security loan immediately following bankruptcy proceeding, nevertheless the less than resources may help.

6 methods for taking a house equity loan shortly after personal bankruptcy

Taking a house guarantee mortgage once a personal bankruptcy is tough but there are methods you might improve your odds of acceptance. Especially, borrowers would want to:

Understand the timing

Personal bankruptcy can also be stay on your credit score for anywhere from eight to 10 years, with respect to the variety of case of bankruptcy filed. Although this may appear unsatisfactory, it is vital to recognize that lenders generally speaking be more happy to assist you eventually.

Due to the fact case of bankruptcy submitting movements after that into early in the day, loan providers can get view your debts way more favorably, upping your odds of providing acknowledged for property guarantee loan . Very in place of implementing after a personal bankruptcy submitting, be patient and you can proactive about your credit at that time instead.

Reconstruct the borrowing

After bankruptcy proceeding, reconstructing the borrowing is to end up being important. Begin by acquiring a copy of your credit report to make sure accuracy. Following, focus on paying bills timely, reducing outstanding costs and you can gradually enhancing your credit history .

Setting up an optimistic fee record commonly show loan providers which you is actually invested in monetary responsibility. You’ll be able to consider using secure playing cards or becoming an enthusiastic licensed member to the a friend or household members member’s bank card in order to include confident guidance into the credit history.

Shop around to own lenders

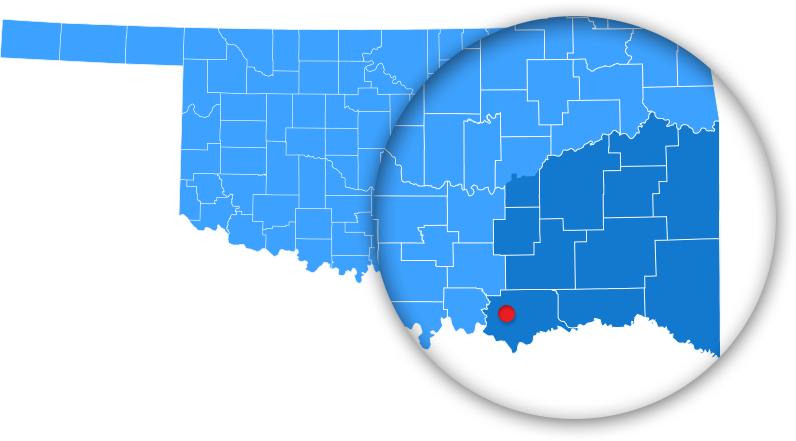

Only a few domestic equity https://paydayloanalabama.com/needham/ loan providers get an identical requirements or policies out-of article-personal bankruptcy financing – in the same way not most of the loan providers give you the exact same versions out-of loans, words otherwise prices. So, if you are looking to possess a property equity financing shortly after case of bankruptcy, it can benefit that make sure to look and you may shop around to own loan providers exactly who focus on handling borrowers whom have experienced monetary setbacks.

Such as for instance, while traditional financial institutions could have stricter criteria, you will find financial institutions and online house collateral loan providers that become more versatile in their review processes. Because you make your research, make sure to compare interest levels, terms and you may fees to get the very beneficial selection for your facts.

Envision a great co-signer

A co-signer that have a strong credit rating can also be notably boost your opportunity out-of securing a property equity mortgage once bankruptcy. After you include a beneficial co-signer so you’re able to financing, they’re fundamentally vouching for your capability to pay back the loan, offering loan providers additional promise – which is crucial after a bankruptcy.

Although not, you will need to recognize that the fresh new co-signer make use of is actually similarly accountable for the loan, and one standard you are going to adversely impression their credit, so ensure that you be able to pay off brand new financing in advance of incorporating a new cluster to the obligations. Unlock correspondence and you can faith are fundamental when involving a co-signer on the loan application processes.

High light confident economic change

When obtaining a property equity mortgage after a case of bankruptcy, it assists to be prepared and offer evidence of confident monetary transform you’ve made from the go out because the. This might are stable employment, improved earnings or winning management of almost every other debts. Appearing responsible economic behavior and a connection in order to improving your economic standing will make a confident impression into lenders. You to, subsequently, can raise your chances of qualifying for a loan.

Search elite guidance

Navigating the causes having a house guarantee loan just after bankruptcy might be tricky, therefore seeking elite group recommendations are going to be a smart relocate some items. Such as, it can help to check out an economic advisor otherwise financial representative just who specializes in blog post-personal bankruptcy financing. They can bring personalized recommendations predicated on your specific disease, help you understand the standards of different loan providers and guide you from app process.

The conclusion

Protecting property collateral loan once case of bankruptcy is without question a challenging task, however it is maybe not impossible. By the understanding the time, actively reconstructing the credit, doing your research to have loan providers, considering an excellent co-signer, showing self-confident economic transform and looking elite group pointers if you want it you could improve odds of getting property collateral mortgage that works for you. The method may not be easy, even when, so persistence and you may effort are foundational to issues on your excursion to your monetary healing.

Angelica Leicht are elder publisher for Managing Your finances, where she produces and you will edits content towards the a selection of personal loans information. Angelica in past times held modifying spots at Effortless Dollar, Appeal, HousingWire or any other monetary publications.