If we range from the notice fees on the dining table might complete to help you $. This is the just like the latest fund charge (ignoring the brand new step one? change because of rounding) which was determined in Example 5.

A long lasting loan that is used on acquisition of a house is called a mortgage. This means that in case your mortgage holder is unable to generate brand new payments the lending company takes possession of the property.

For example take the purchase out-of a property which have an effective twenty year mortgage. Brand new consumer you will sign home financing agreement for a five year title. The mortgage contract ought to include the speed, the latest frequency regarding money and additional guidelines which may let the mortgage holder while making lump sum payments otherwise replace the percentage amount. After the 5 year identity a new agreement are needed plus the criteria of one’s financial usually changes.

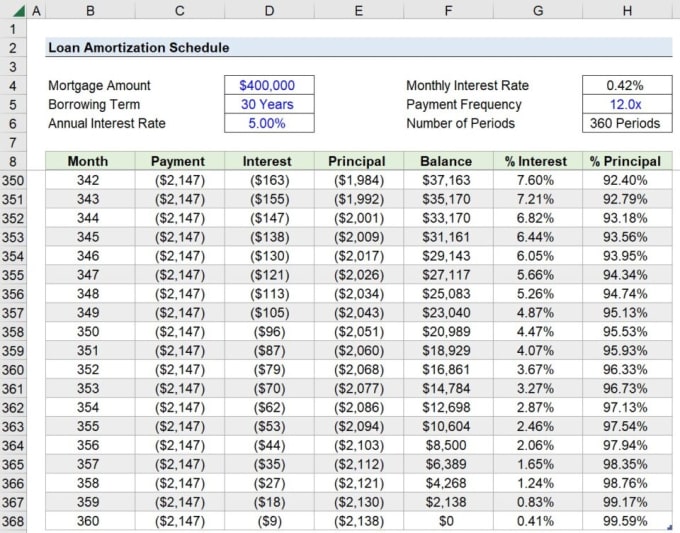

Though it is achievable to-do the data by hand, that’s outside of the range of this book. We are going to use technical so you can estimate brand new occasional money and you may interest costs in order to build a keen amortization agenda.

Mortgages have a tendency become for extended schedules than just a keen cost loan additionally the terms of the loan can sometimes changes over the course of the mortgage

Analogy 8 have a tendency to illustrate you to definitely amortizing a mortgage is much like amortizing most other loans other than the loan amortization fundamentally pertains to of a lot a whole lot more commission periods.

Good $400,100000 house is purchased that have a great 20% down-payment into the a 20-12 months home loan from the a fixed interest of step three.4%.

e) Use the table to decide how much of earliest year’s costs goes towards interest as well as how much will go with the the main.

f) Make use of the table to determine simply how much of your latest year’s money is certainly going into the notice and exactly how much is certainly going into the main.

e) Of the very first year’s costs, nearly 50 % of, $ten,, is certainly going towards the appeal. $11, is certainly going for the paying off the primary.

A 20-12 months mortgage was received purchasing a great $550,one hundred thousand house with a fifteen% down-payment in the a fixed rate of interest from 4.6%.

e) Use the dining table to choose exactly how much of the basic year’s costs will go to the attract and how much is certainly going on the the main.

f) Use the dining table to choose exactly how much of your own finally year’s costs is certainly going towards desire and exactly how far goes into the primary.

An early couples have obtained an inheritance as well as have enough money to have an advance payment on their basic domestic. It propose to take out a twenty-five 12 months home loan during the an enthusiastic interest away from step three.8%. He is given an alternate family for $750,000 or a smaller old domestic having $380,100. Once they choose the large household it intend to generate a great 20% deposit. Towards the cheaper faster home they could afford a good thirty five% deposit.

a) Explore an online home loan calculator to select the downpayment, new payment additionally the overall appeal paid for every one of both homes.

Its entitled home financing once the credit service requires that our house be taken while the collateral for the financing

https://cashadvanceamerica.net/loans/easy-loans/

A couple keeps won $fifty,100 on the lottery plus they put which into the the purchase off a holiday cottage or a home. It intend to make a good ten% down-payment and are also given a twenty five seasons financial at an effective rates regarding 2.9%. They are determining within purchase of a cottage having $five hundred,100 otherwise property getting $880,100.

a) Use an online financial calculator to select the down payment, the newest monthly payment together with full notice covered brand new bungalow and for the household.