Various household guarantee points, designed in order to diverse monetary requires, are given of the Huntington Bank. Property owners can control the property’s equity effortlessly because of the understanding such solutions. That have a home equity financing out of Huntington Bank, residents gain the capability to borrow secured on their property’s security. Generally speaking, repaired interest levels and predictable monthly premiums characterize these funds. Such as for example provides make sure they are best for capital large expenditures such as for instance house renovations otherwise debt consolidation.

Property owners can make use of Huntington Bank’s HELOCs, which offer an adaptable monetary device having being able to access funds because the necessary. Instead of conventional money that offer individuals an initial lump sum payment, HELOCs furnish good rotating line of credit throughout the years. This unique ability tends to make HELOCs especially very theraputic for methods featuring fluctuating will set you back or lingering expenditures eg home renovations otherwise informative activities. Furthermore, than the most other borrowing from the bank models, HELOCs frequently promote all the way down initially interest rates. This is going to make all of them a powerful selection for consumers interested in cost-effective resource choices loans in South Coventry.

HELOCs then give property owners into the advantageous asset of versatile borrowing. They’re able to want to availability financing as long as required, a component such beneficial in cash flow government. The borrower retains discernment more loans allocation. Alternatives start around renovations, combining obligations, or handling unexpected expenses. Nevertheless, consumers need tread cautiously and practice discipline inside their usage of good HELOC. Proceeded entry to fund might precipitate overspending or an unanticipated increase in debt stream.

- Consideration: When you are HELOCs bring flexibility, individuals ought to know one interest rates can be fluctuate over time, probably increasing the monthly premiums.

- Caution: Individuals need to have an obvious installment package set up to eliminate dropping towards a cycle out of debt, since the failing continually to repay the fresh borrowed number can be place their property susceptible to property foreclosure.

Comparing Costs and Conditions

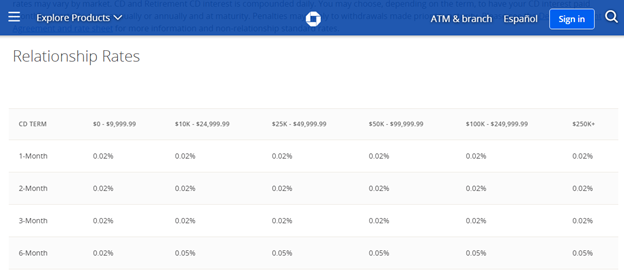

People need make comprehensive search and examine this new costs and terminology Huntington Bank even offers in advance of investing a house guarantee unit. The attention cost is significantly impact the overall credit pricing. Hence, knowledge when the these types of rates is actually repaired otherwise changeable is essential, including offered the way they you’ll change over day. And, consumers should take into account other variables such as for instance settlement costs, payment words, and you will one associated fees.

Additionally, borrowers need to take into account the overall cost regarding that loan and charges or costs in spite of the prospective attractiveness of low interest. Particular loans could possibly give down rates. Although not, they might as well as impose highest closing costs and you will annual costs you to definitely is also combat you can easily savings. Homeowners is make their financial requires that have financial limitations and also make the best decision by the meticulously evaluating these factors.

- Noteworthy: Certain family collateral points may offer introductory advertising and marketing cost, which can be less than the high quality costs getting a small months. Individuals must look into just how long these advertisements cost history and you may just what these rates would be following the advertising and marketing months comes to an end.

- Just what to not ever skip: Also evaluating cost, consumers should also take note of the installment terms and conditions and you can one potential charges to possess very early payment or late money. Information these terms and conditions will help individuals end unanticipated can cost you and you will punishment down-the-line.

App Processes and requirements

Multiple measures take part in making an application for a house security tool away from Huntington Lender. Consumers need get ready to incorporate help paperwork. To exhibit the loan repayment feature, individuals typically have to fill in earnings evidence like shell out stubs otherwise tax statements. More over, providing assets information becomes extremely important. It offers the newest appraised worthy of and people outstanding financial stability regarding the fresh new said assets.

Huntington Bank, in addition, evaluates the applicant’s creditworthiness to establish the eligibility to own property equity equipment. A strong credit history and lowest financial obligation-to-earnings proportion boost acceptance opportunities. They could in addition to produce far more favorable mortgage terms and conditions. Nonetheless, consumers with incomplete borrowing can always be eligible for property security device, in the event possibly from the highest interest levels or less than even more conditions.

- Fact: Huntington Financial may require a house assessment as part of the application process to influence the fresh property’s most recent ount regarding guarantee available for borrowing.

- Consideration: Borrowers might be open to the application process to require some date, as bank should feedback all files carefully and you can conduct an intensive assessment of one’s applicant’s finances.

Handling Threats and you may Responsibilities

House guarantee factors grant people economic self-reliance, yet , it harbor inherent dangers you to definitely borrowers need certainly to think that have. Notably, this new peril of value of decline leads to bad security. In the event the a great home’s worthy of lowers, individuals will discover on their own owing an expense exceeding their financial and you can home equity loan shared. So it instability complicates efforts for sale otherwise refinancing.

Furthermore, borrowers need certainly to will always be aware of interest price fluctuations, especially those carrying an adjustable-rates family security financing or line of credit. An uptick throughout these rates you are going to intensify monthly premiums and set considerable stress on the borrower’s monetary plan. To alleviate which chance, property owners would be to think of both refinancing into a fixed-speed loan otherwise creating the right repayment method that circumstances within the it is possible to rates nature hikes.

- Important: Residents is daily display screen their home security membership statements and sustain track of their outstanding equilibrium and offered borrowing.

- Note: Borrowers should be familiar with any possible taxation effects relevant that have domestic collateral facts.

Conclusion

Residents, supported by the property’s collateral, discover versatile capital choice off Huntington Bank’s house security items. Knowing the readily available diverse list of offerings, contrasting prices and you can terms and conditions vigilantly, and evaluating the financial situation carefully are very important to have individuals. They empowers these to create told behavior. The goal is to to complete desires effortlessly when you are handling risks prudently.