A part-date jobs would not prevent you from bringing a home loan. You can easily only have to see some particular requirements. Observe how lenders take a look at people performing part-some time and you skill adjust your chances of bringing a loan.

Yes, it will be easy to own a member-big date employee to homes a mortgage. But despite this type of a whole lot more enlightened days of versatile a position agreements, it isn’t as easy as you could hope for Australians performing part time to find the deal they want of home financing lender.

While unemployment prices in australia was basically comparatively lowest for the majority go out, studies have shown how exactly we will work has evolved rather more than during the last three decades.

Centered on Australian Bureau regarding Statistics and you may Put aside Bank investigation, on the one out of about three operating Australians work part time (less than 35 occasions weekly). During the 1967, the amount of Australians operating part time try lower than you to within the 10.

Over fifty percent away from Australia’s region-go out gurus today are casual group. That it measures up with only 10% out of full-go out pros that thought casuals. Actually, Australia has among the large offers from group involved with part-time really works round the all set-up places.

A great deal more Australians work faster times using selection (possibly since they are together with studying). Someone else performs in your free time because they’re not able to see complete-big date a career. Although result is more people are struggling to depend with the a complete-big date salary while the evidence of its financial balance once they want in order to use when it comes to goal, especially to get a property.

The difficulty, naturally, is the fact home-loan companies usually discover people who performs part time as high-risk individuals. Even although you provides grounds for performing part-time, of a lot lenders might possibly be careful.

This will enable it to be problematic for those who work in region-time work to find the brand of mortgage they could need. It might even be challenging to find a home loan during the all of the.

It must not surprise your that every loan providers favour people that an entire-date employment. It suggests him or her your debtor has actually a specific level of commitment to a family and you may world, and you may indicates a greater number of newest (and you will coming) balance and you can financial certainty.

Home loans are typically bought out a phrase from 25 or thirty years. Lenders would like to feel an amount of spirits that consumers are able to pay it off using and make complete and you will regular payments. To have loan providers, people in full-date work feel like a much safer choice (the theory is that anyway) compared to those who happen to be performing part time otherwise come into an excellent casual role.

It can be problematic for those who commonly holding off an effective full-time jobs so you can qualify for a home loan beneath the usual credit conditions. Also showing simply how much you have made will likely be challenging, let alone bringing every called for records, and you may demonstrating that you can to settle the loan.

An identical pertains to anyone who does not perform traditional work … perhaps those people who are worry about-employed or into the price, or those who work for an agency or services business. (See here getting suggestions about the way to get home financing while you are notice-working.)

However, that doesn’t mean which you are unable to get a mortgage if you are engaged in area-go out functions. No less than, very lenders should see that you have got kept the latest part-day job for some time. Of numerous may also wish to know, including, for those who functions part time and also have the full-date part.

Because the times enjoys altered and also as alot more Australians make the most of a lot more versatile office preparations so has actually economic institutions’ dated-designed thinking. Particular lenders today appreciate this you could potentially choose really works part big date, and so are happy to mention how they can figure that loan that fits your needs. Might test thoroughly your lives and you will admiration your decision. Its by way of such as for example lenders which you have a heightened chance of protecting home financing.

Part-date professionals certainly provides a harder occupations convincing loan providers that they is appropriate mortgage people than full-timers. For example, extremely loan providers often expect one illustrate that you have stored their area-big date occupations for at least 1 year.

Even though it may differ ranging from lenders, extremely will need to visit your tax statements or classification permits into earlier 2 yrs as well as reasonable evidence of income, that is usually a couple latest payslips.

But what will make it specifically hard is that particular lenders evaluating the job will imagine 50 % of the cash out of your part-time character. Anyone else will use their complete income since techniques. Basically, significant banking institutions have harder requirements than simply pro loan providers.

Such conditions and terms into area-big date experts helps it be hard to show your getting sufficient currency to meet up with the new money on the a mortgage. It may also limit the number of household-mortgage products which are available to you.

Really does boosting your really works occasions help because a member-time staff?

Yes. Starting to be more era out of your workplace can frequently assist you in finding a lender that’s prepared to give you more substantial family loan. Depending on the issues, you might also need to consider looking an entire-time business whether your home loan solutions do not fulfill your own expectations.

Although you can easily have more really works, lenders will likely waiting around half a year to see how the full time youre on the the brand new points. They are going to need to know that your particular modified really works patterns and the latest earnings accounts is steady and renewable. Whatever happens, you will need to offer subsequent proof of earnings and you will a good page payday loan Fort Lupton from your workplace.

Exactly how otherwise ought i boost my odds of providing a house loan?

Given that a part-date employee, there are a few things you might possibly perform to switch your chances of getting just the right home loan:

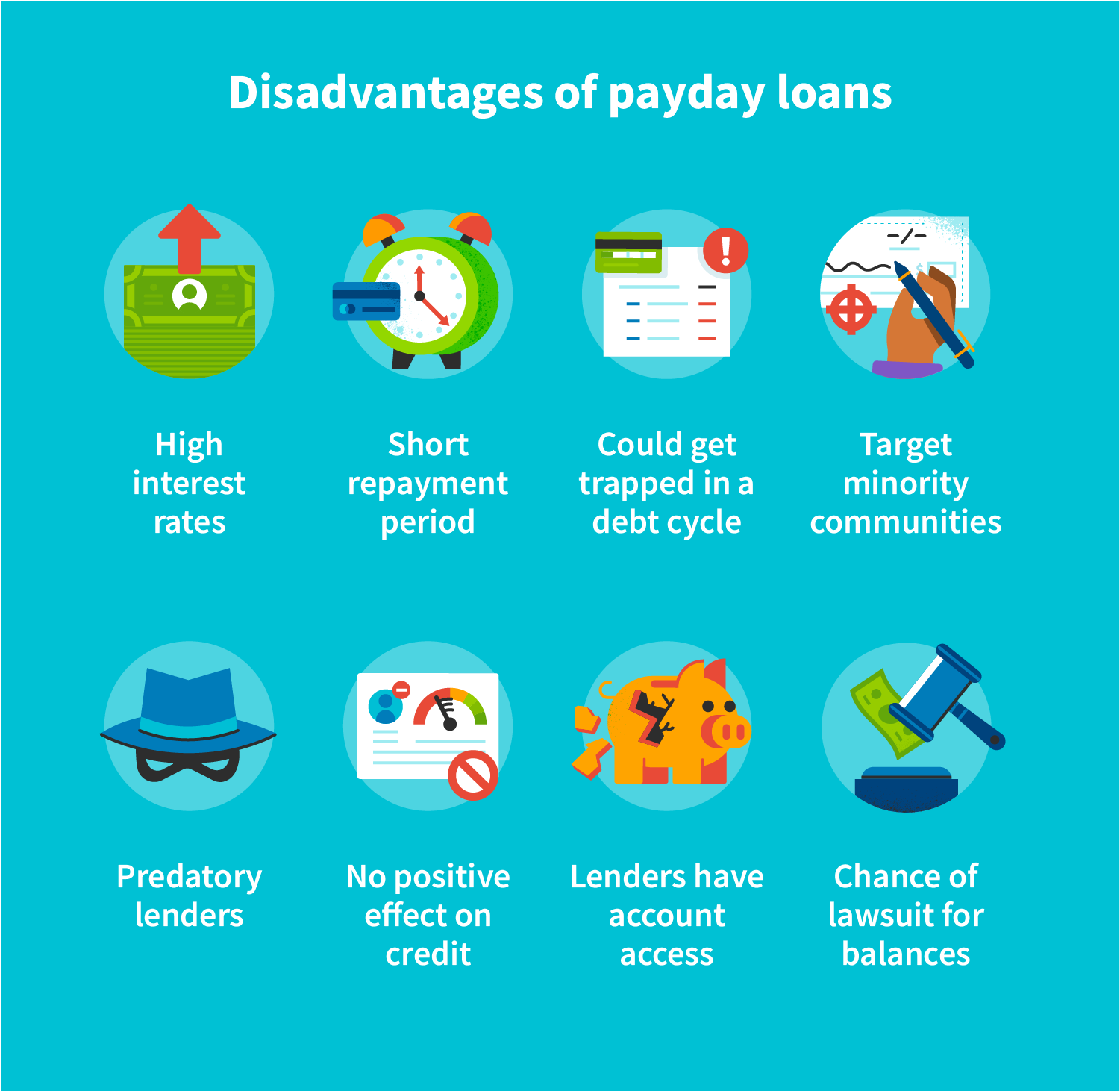

- Ensure your financial issues are located in a beneficial purchase. Try to cut the amount of cash you owe on the one personal loans and handmade cards before you apply getting that loan. You might also consider coping with your potential financial to consolidate such costs into your home loan during the a lesser interest, whilst you usually nonetheless would like to try to repay these types of private expenses as fast as you could potentially.

- Make fully sure your credit score is right. You could request a copy of your own credit file observe just what lenders will see once they assess the application. Pick right here for additional information on where to find your borrowing from the bank rating.

- Guide inside the a simple phone call with the help of our customer care party, who are able to get a professional financial to possess a great financing one to aligns along with your need.

What to do second

Prior to people choices, you really need to email address you whatsoever ones will allow you to know very well what you should do and supply an informed options to find the financial that best suits you finest. With the aid of an expert, you can make the best choice for the disease.